The Corporate Transparency Act (CTA) requires businesses to submit Beneficial Ownership Information (BOI) to FinCEN, aiming to increase transparency and prevent financial crimes.

As of today, November 27, 2024, Lake Forest, Illinois, business owners have 35 calendar days (or 25 business days) remaining to file their BOI report with FinCEN—act promptly to avoid fines of $500 per day!

What You Need to Do:

1. Determine if Your Business Must File.

Most LLCs, corporations, and small businesses qualify as "reporting companies." Exceptions include publicly traded and certain regulated entities.

2. Identify Your Beneficial Owners.

Beneficial owners are individuals who have substantial control or 25% or more ownership of your business. For example, a co-owner of a Lake Forest consulting firm with a 30% stake and decision-making power qualifies.

3. Gather the Required Information.

Prepare:

-

Your business’s name, address, and EIN.

-

Each beneficial owner’s name, address, DOB, and ID details.

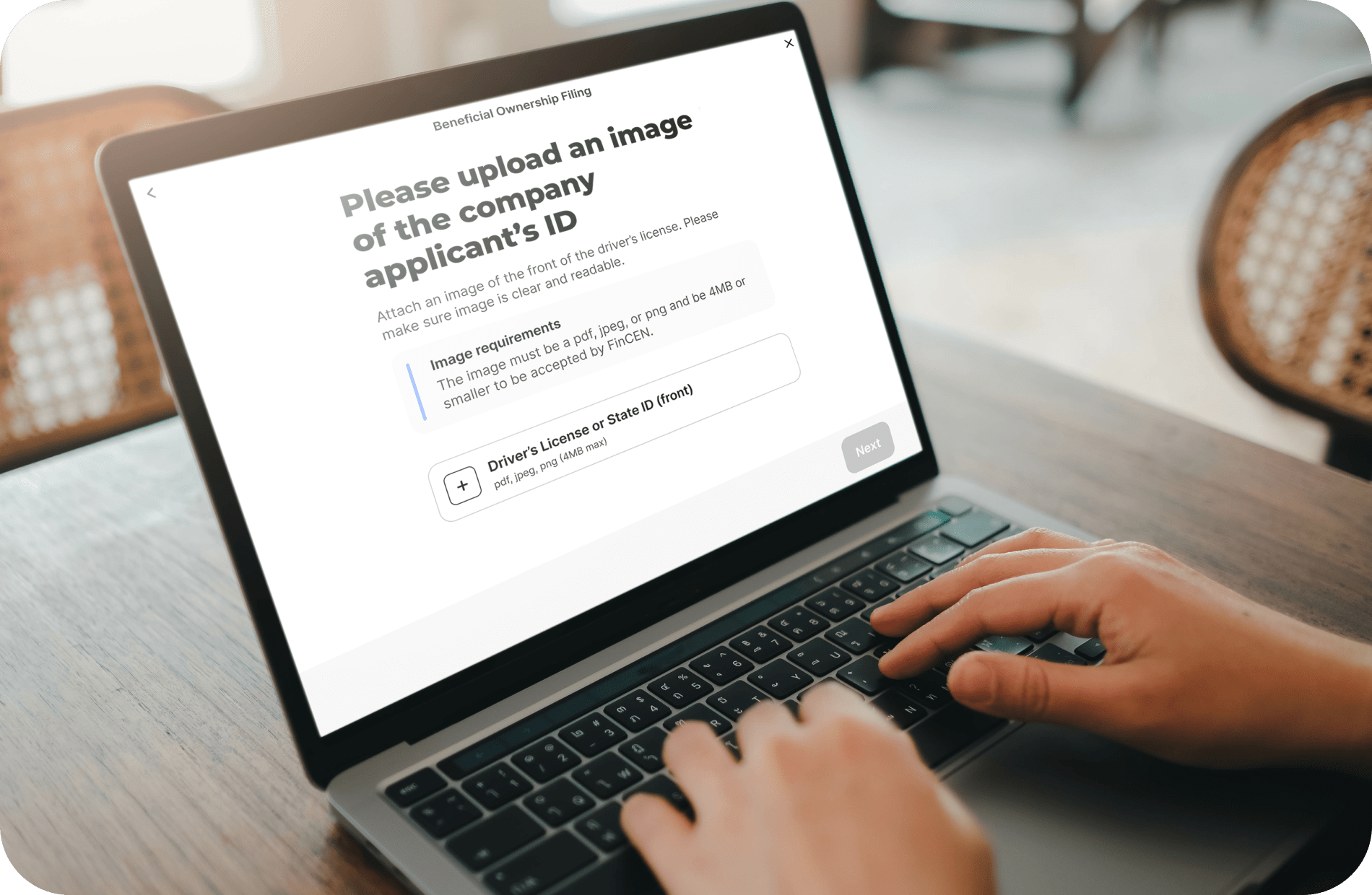

4. File Your BOI Report.

Deadlines:

-

Existing businesses: 01/01/2025.

-

New companies (2024): File within 90 days of formation.

-

New companies (2025+): File within 30 days of formation.

ZenBusiness can assist with filing and simplify the process for you.

Key BOI Filing Details:

Who Needs to File?

Most small LLCs, corporations, and similar entities in Lake Forest need to file. Exemptions apply to publicly traded companies and certain regulated businesses. For example, a family-owned Lake Forest bakery must file, but a national retail chain would not.

What Is a Beneficial Owner?

A beneficial owner is anyone who either:

-

Exercises substantial control over the business, OR

-

Owns 25% or more of it.

For example, the 40% stakeholder of a Lake Forest real estate firm actively involved in decision-making is a beneficial owner.

What Information Is Needed?

You’ll need details about your business and beneficial owners, including:

-

Business name, address, EIN.

-

Owners’ names, addresses, DOBs, and identification information.

How and When to File:

BOI reports must be submitted electronically to FinCEN. Deadlines are:

-

Existing businesses: File by 01/01/2025.

-

2024 startups: File within 90 days of formation.

-

2025+ startups: File within 30 days of formation.

Learn how ZenBusiness can streamline your BOI filing today.

Penalties for Non-Compliance:

Failure to file may result in fines up to $500 per day or $10,000 in total, along with potential criminal charges. A 90-day safe harbor allows time to correct errors.

Additional Resources:

Your input makes a difference! Take a few minutes to complete our BOI survey by December 18, 2024, and for every 25 responses, our Chamber will receive a $100 donation. [Take the survey here!] Thank you for supporting our Chamber and sharing your feedback!

*As of December 3, 2024, a Texas federal district court has issued a preliminary injunction for all states to block the CTA and its relevant regulations. However, filing your BOI will help you avoid fines if this injunction is overruled.